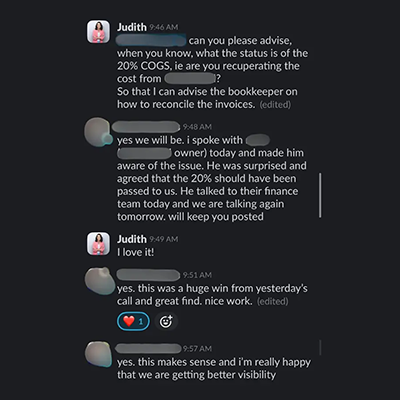

$2M USD Hard Cash Recovery

The Challenge

Despite strong marketing performance, this established brand was experiencing a disconnect between their success metrics and actual bank balance. Working with the same bookkeeper and accountant for years, everything appeared "fine" on paper, but the founder couldn't shake the feeling that something wasn't right with their cash flow.

The Strategy

Implemented proper ecommerce specific sales channel reconciliation processes. Identified that supplier was only paying 32% instead of contracted 52% of net revenue, a 20% COGS recovery issue that required direct supplier negotiation.

The Result

Recovered $2M in hard cash, doubled their net profit margin in 4 months, and increased net revenue by 20% through proper accounting reconciliation and supplier payment corrections.

Doubled

Net Profit Margin

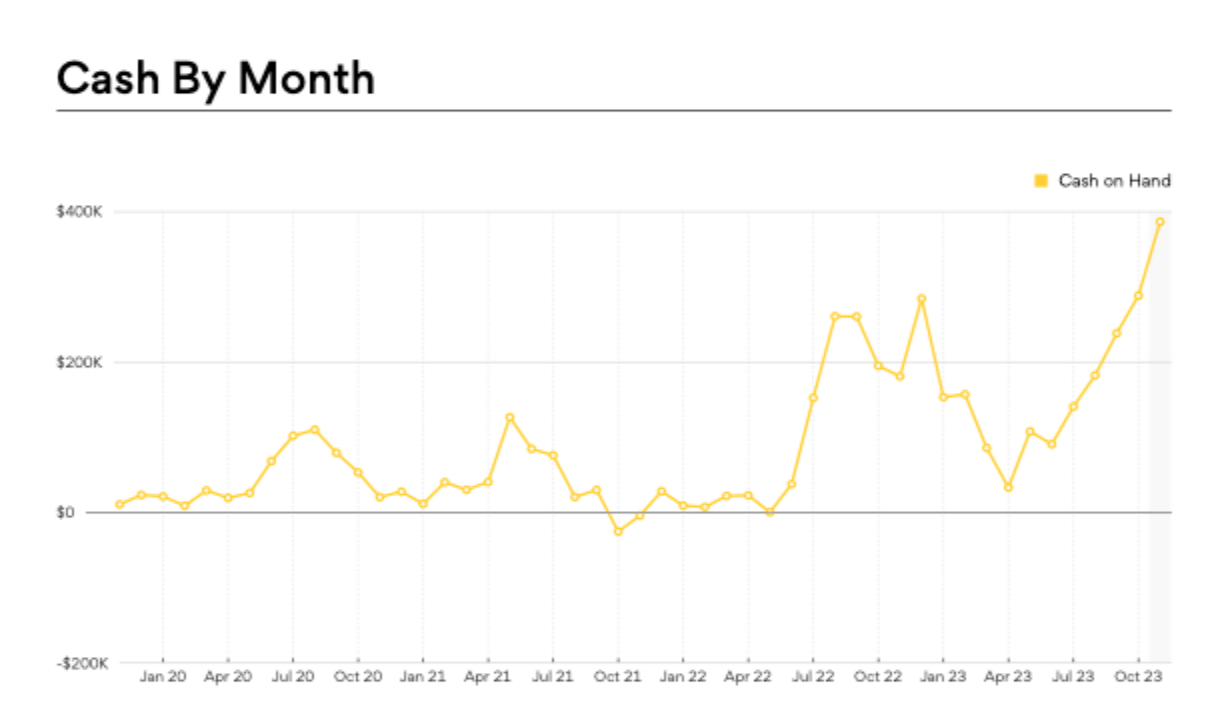

Breaking the Cash Flow Nightmare

The Challenge

Every sales surge triggered a paralyzing cash crunch. Despite hitting $7M in revenue, the business was constantly trapped in cash flow chaos, unable to capitalize on growth opportunities.

The Strategy

We implemented a specialized cash management strategy designed for their specific product cycles, seasonal patterns, and marketing rhythms.

The Result

Transformed from cash flow anxiety to confident growth with a substantial cash reserve, enabling strategic decision-making instead of survival mode.

The Six-Figure Tax Recovery

The Challenge

Despite strong revenue growth, this established brand was trapped in a dangerous debt cycle, financing every inventory purchase with high-interest credit and struggling to understand where their profits were disappearing.

The Strategy

We implemented a comprehensive cash management system designed specifically for their product cycles and marketing rhythms, while simultaneously analyzing their cash flow patterns to eliminate debt dependency.

The Result

Complete elimination of all inventory debt and establishment of a self-funding inventory system that became their biggest competitive advantage.

15%

Revenue Duplicates Removed

ZERO

Additional Sales Needed

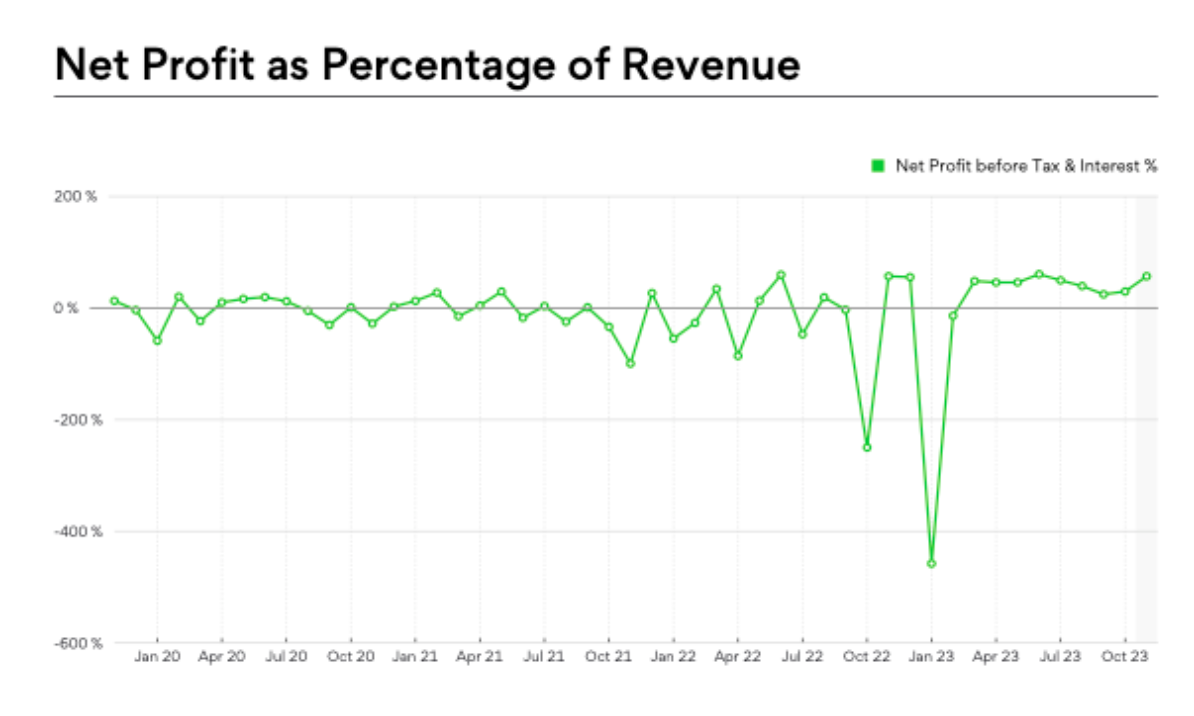

The Hidden Truth About Profitability

The Challenge

After ten successful years of growth, the founder felt like profit was mysteriously disappearing despite healthy revenue. Their bookkeeper had never conducted a proper stock take, leaving their biggest asset invisible.

The Strategy

We switched from cash to accrual accounting and completed their first comprehensive stocktake in a decade, revealing the true state of their inventory and financial position.

The Result

Discovered they were actually 32% more profitable than their reports showed, transforming their confidence and growth strategy overnight.

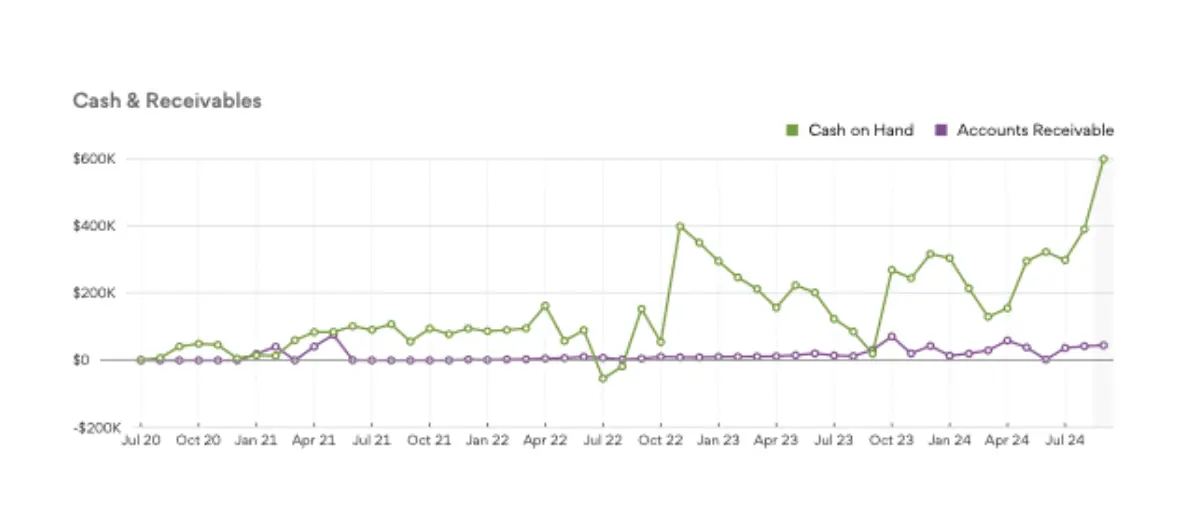

From Debt Spiral to Self-Funded Growth

The Challenge

Despite strong revenue growth, this established brand was trapped in a dangerous debt cycle, financing every inventory purchase with high-interest credit and struggling to understand where their profits were disappearing.

The Strategy

We implemented a comprehensive cash management system designed specifically for their product cycles and marketing rhythms, while simultaneously analyzing their cash flow patterns to eliminate debt dependency.

The Result

Complete elimination of all inventory debt and establishment of a self-funding inventory system that became their biggest competitive advantage. $47K Interest Eliminated 8 Months Debt-Free Timeline

8 Months

Debt-Free Timeline

Achieved

Self-Funded Growth

Plugging the Invisible Profit Leaks

The Challenge

Money was consistently slipping through invisible cracks in their financial system. They couldn't confidently fund operations, inventory, or tax obligations without constant stress.

The Strategy

We conducted a comprehensive profit leak analysis and implemented a tailored cash management system that addressed their specific operational challenges.

The Result

Complete financial stability with the ability to cover all operations, inventory, and tax obligations from their own funds consistently.

100%

Self-Funded Operations

Turned Customer Acquisition Losses Into First-Order Profitability

The Challenge

Unknown to the founders, they were losing money on every new customer acquisition, taking up to six months just to break even. Their marketing strategy was built on fundamentally flawed assumptions.

The Strategy

We analyzed margins by SKU, identified true customer acquisition costs, and reset their marketing targets to match real profitability metrics.

The Result

Completely optimized marketing strategy that generates profit from month one on every new customer while clearing dead stock.

Profitable

First-Order Status

Pure Profit

Repeat Purchase

Optimized

SKU-Level Margins

The Failed Sale That Became a Success Story

The Challenge

Inventory chaos with multiple purchase orders for the same stock, unreconciled entries, and inflated liabilities cost them a business sale due to inaccurate financials.

The Strategy

We completely untangled their inventory system, cleaned up all accounts, corrected the balance sheet, and implemented a simple but effective purchase order management process.

The Result

From losing a sale opportunity due to messy books to being positioned for a profitable and stress-free future exit with clean, accurate data.

$340K

Balance Sheet Corrected