That's why I developed a unique approach that bridges this gap, combining forward-looking financial projections with marketing performance metrics to create sustainable growth systems.

I was formerly a corporate finance… not your average accountant. Most accountants are focused on compliance, not strategy. They'll file your taxes, sure, but they won't help you optimise your eCommerce operations.

I understand both the financial side and the marketing side of eCommerce, giving me a unique perspective on how to grow your business profitably. I've been building up businesses, implementing proven financial systems, and following data-driven principles.

So imagine having a business where you've got complete clarity on your finances, and you don't have to wonder where your money is going.

Or if things slow down, you have a long warning time to know that you need to make changes.

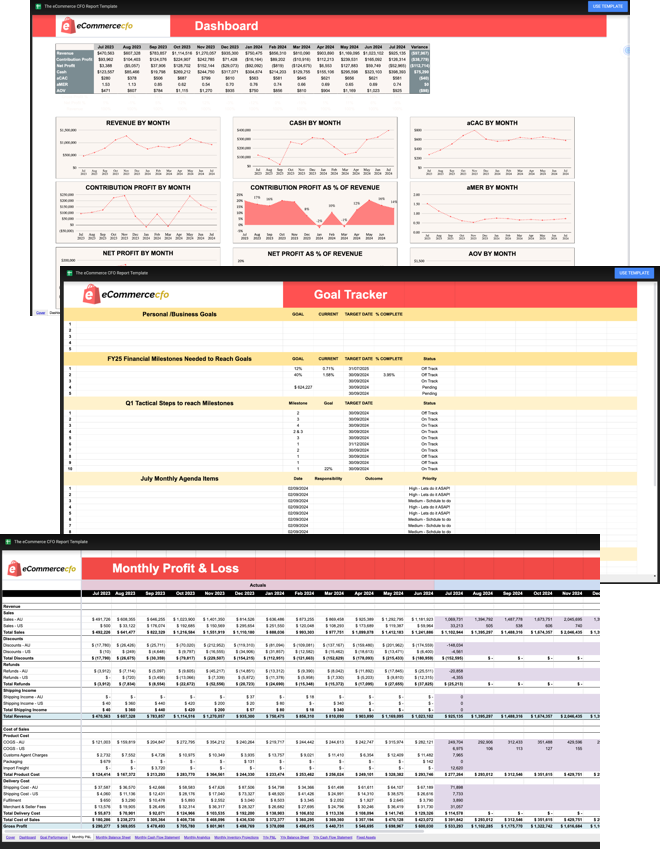

Make Data-Driven Decisions for Your eCommerce Venture. Instead of struggling with managing and costing your diverse inventory, you'll have clear insights into your financial health.

Maintain healthy cash flow. Rather than grappling with cash flow issues, you'll have systems that give you complete visibility and control.

Track revenue accurately across multiple sales channels. Instead of finding it challenging to track revenue from multiple sales channels, you'll have consolidated, clear reporting.

Know exactly where to spend your money. Instead of being unsure where you should be spending your money, you'll make confident, data-backed decisions.

Understand how you compare to industry standards. Rather than wondering how your business stacks up, you'll know exactly where you stand and what to improve.

Simplify complex financial reports. Instead of being overwhelmed with financial reports and data across your marketing channels, you'll have clear, actionable insights.

Enter your details to unlock instant access to my calculator, no guesswork, no fluff.